The Federal Board of Revenue (FBR) has added a new feature in its Tax Asaan app for the Tajir Dost Scheme. This scheme is designed to help unregistered businesses. It encourages them to declare their assets and income.

If you want to register for the Tajir Dost Scheme, this article will guide you. You will learn everything you need to know.

Contents

What is the Tajir Dost Scheme?

The Tajir Dost Scheme is a voluntary tax compliance program in Pakistan. It is designed to help unregistered businesses. By joining the scheme, businesses can declare their assets and income.

The scheme offers several benefits. One of the main benefits is reduced tax rates. Businesses may also enjoy simplified tax procedures. This makes it easier for them to comply with tax laws.

The goal of the Tajir Dost Scheme is to bring more businesses into the tax system. By doing so, it helps the economy grow. This scheme is a good opportunity for businesses to regularize their operations.

Tajir Dost Scheme Eligiblilty

The Tajir Dost Scheme is likely aimed at unregistered businesses in Pakistan. While the official eligibility criteria haven’t been confirmed, the scheme probably targets certain types of businesses.

Here are the types of businesses that might be eligible:

- Retail Stores: Small shops and retailers who have not registered for taxes.

- Wholesalers: Businesses that sell goods in bulk to retailers.

- Service Providers: Companies that offer services like repair, consulting, or other professional services.

These businesses are encouraged to join the scheme to declare their assets and income. By doing so, they can benefit from reduced tax rates and simpler tax procedures.

How to Register for the Tajir Dost Scheme?

To register for the Tajir Dost Scheme, the process may involve a few simple steps. While the exact steps might still be in development, here is a likely scenario based on available information:

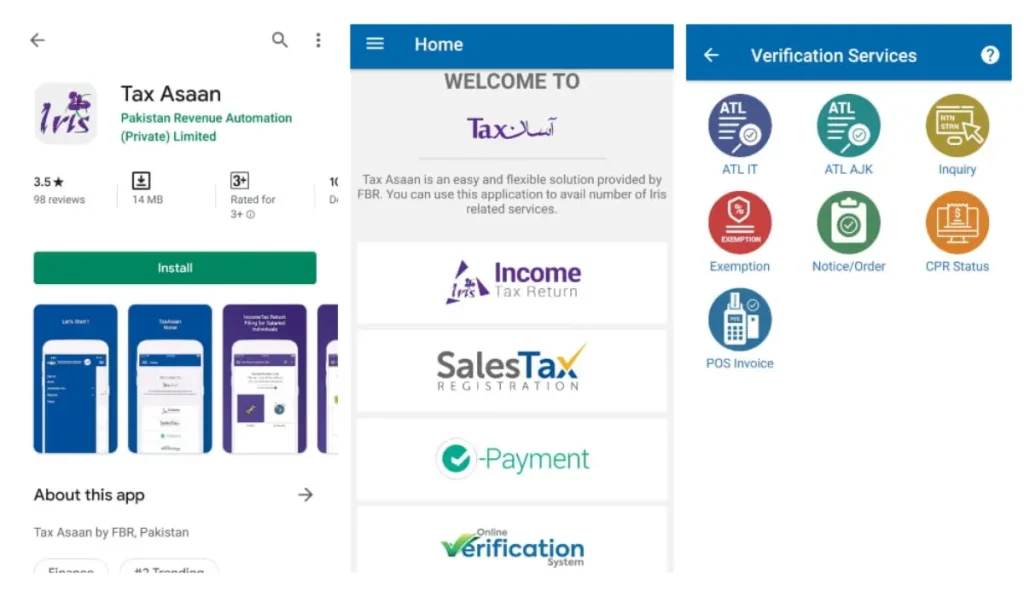

- Download the Tax Asaan App: First, you need to download the Tax Asaan app. You can find it on the Google Play Store or Apple App Store.

- Open the App: Once the app is installed, open it on your phone.

- Find the “Tajir Dost Scheme” Option: Look for the “Tajir Dost Scheme” option within the app. This option might be new, so it could be featured prominently.

- Follow On-Screen Instructions: After selecting the Tajir Dost Scheme option, follow the instructions on the screen. You may need to enter your ID card number, mobile number, and other important details.

- Submit the Form: Once you have filled in all the required information, submit the registration form.

By following these steps, you can register for the Tajir Dost Scheme and take advantage of its benefits.

Must-Register Cities in Pakistan for the Tajir Dost Scheme

In Pakistan, registration under the Tajir Dost Scheme is compulsory in several cities. If you have a business in any of these cities, you need to register. Here are the cities where registration is mandatory:

- Abbottabad

- Attock

- Bahawalnagar

- Bahawalpur

- Chakwal

- Dera Ismail Khan

- DG Khan

- Faisalabad

- Ghotki

- Gujranwala

- Gujrat

- Gwadar

- Hafizabad

- Haripur

- Hyderabad

- Islamabad

- Jhang

- Jhelum

- Karachi

- Kasur

- Khushab

- Lahore

- Larkana

- Lasbela

- Lodhran

- Mandi Bahauddin

- Mansehra

- Mardan

- Mirpurkhas

- Multan

- Nankana

- Narowal

- Peshawar

- Quetta

- Rahim Yar Khan

- Rawalpindi

- Sahiwal

- Sarghoda

- Sheikhupura

- Sialkot

- Sukkur

- Toba Tek Singh

If your business operates in any of these cities, make sure to complete your registration under the Tajir Dost Scheme. This will help you comply with the tax regulations and benefit from the scheme’s offerings.

Help me

M Imran mira bi ghr ni hi silab ki waj sa to p l z to mira bi ghr banwa doo p l z mobile 📲 nabar 03458166906

Nadeem

Plz help me in study

I need some business