Are you a young person in Pakistan? Do you have a good idea for a business but need money to start? The Prime Minister’s Youth Business and Agriculture Loan Scheme (PMYB&ALS) can help you! This program gives loans to young people who want to start or grow their business. In this article, I will show you how to apply for this loan and start your business.

Contents

What is Prime Minister Youth Loan Scheme (PMYB&ALS)?

PMYB&ALS stands for Prime Minister’s Youth Business and Agriculture Loan Scheme. It is a special program by the government of Pakistan to help young people start their own businesses. The scheme offers loans with very low-interest rates and simple terms. This means you can borrow money easily and pay it back without too much hassle.

Prime Minister Youth Loan Scheme Tiers

PMYB&ALS loans are divided into three tiers:

| Tier | Loan Amount | Interest Rate |

|---|---|---|

| Tier 1 | Up to 0.5 million PKR | 0% |

| Tier 2 | From 0.5 million to 1.5 million PKR | 5% |

| Tier 3 | From 1.5 million to 7.5 million PKR | 7% |

Eligibility Criteria

Before applying, you need to know if you are eligible. Here are the basic requirements:

- Age:

- You must be between 21 and 45 years old.

- For IT or e-commerce businesses, you can apply if you are 18 years or older.

- Type of Business:

- You can apply if you want to start a Small or Medium Enterprise (SME).

- This includes both new businesses (startups) and businesses that are already running.

- If you are a farmer, you can also apply according to the guidelines provided by the State Bank of Pakistan.

Required Documents

To apply, you will need the following documents:

- Loan Application Form (available in English and Urdu).

- Passport-size Photos (two recent ones).

- Valid CNIC/SNIC with NADRA verification or biometric verification.

- Feasibility Report of your business idea.

- Financial Statements of your business, if it’s already running.

- Clean E-CIB Report (no overdue loans or write-offs).

- Undertakings that you will not take loans from other banks under this scheme.

- Collateral Documents if required by the bank.

- References: Two people with their CNICs.

- Additional Documents: These might include educational certificates, a valid driving license, tax returns, a business license, and utility bills.

How to Apply for Prime Minister Youth Loan Scheme Online

Follow these steps to apply for the loan:

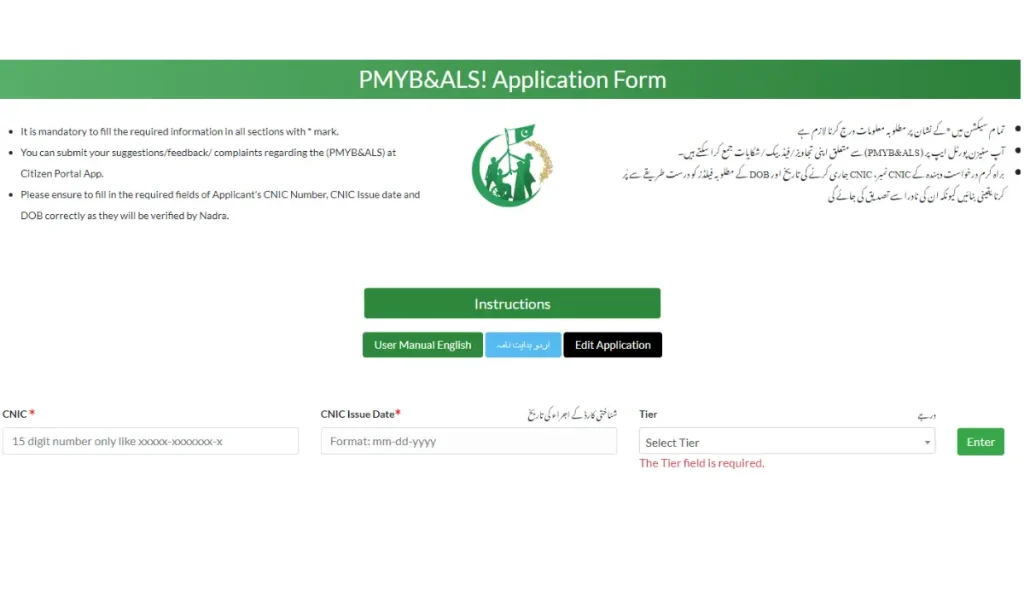

- Visit the Official Website: Go to the PMYB&ALS website.

- Fill Out the Application Form: Complete the form with your personal and business details.

- Submit Required Documents: Make sure all your documents are ready and upload them.

- Track Your Application: After submitting, you can track your application online.

- Calculate Your Loan Repayment: Use the loan calculator on the website to plan how you will repay the loan.

List of Banks and Associated Microfinance Partners for PMYB&ALS Loans

| S.No | Bank | Microfinance Institutions (MFIs) |

|---|---|---|

| 1 | Bank of Punjab | Akhuwat Islamic Microfinance, National Rural Support Program (NRSP) |

| 2 | National Bank of Pakistan | NRSP Microfinance Bank, Rural Community Development Program (RCDP) |

| 3 | Askari Bank | Akhuwat Islamic Microfinance |

| 4 | Habib Bank Limited | SAFCO Microfinance Company |

| 5 | Bank of Khyber | National Rural Support Program (NRSP) |

Why Should You Apply?

This loan program is a great chance for young people in Pakistan. It helps you get the money you need to start or grow your business. The loan comes with low-interest rates and simple terms. It is a good way to make your business dreams real.

Conclusion

Applying for the Prime Minister’s Youth Business and Agriculture Loan Scheme is a simple process.

By following the steps mentioned in this article, you can secure the funds needed to launch or expand your business. Whether you are just starting or already have a running business, this loan can be a big help.

So, gather your documents, fill out the application, and take the first step towards success!

Assalamualaikum sir g mein sacraip ka business kr rha ho kuch loan ki zrort hy taky mein mazeed apna business brha sako thanks

Assalamualaikum sir g mein glass ka business kr rha ho kuch loan ki zrort ha taky mein mazeed apna business baha sako thanks

AOA sir I want to do new business if you can provide loan it’s very beneficial for me required loan 1.5m thanks regards.

Loan ki application k barre ma pata lagana hoto kese application ka status patta chale ga

مجھے پندرہ لاکھ روپے چاہیے میں پورانے کام میں بہتری لاصکوں

Loan k bary man pochna tha

Bacho ki talem k lot help me

Business ke Liye loan chahiye

AOA sir I want to do new business if you can provide loan it’s very beneficial for me required loan 1.5m thanks regards.

Reply

How to give back loan please explain it.